MedTech Monday: Cuban vs. Big Pharma, Robotic Scalpel Faceoff, and Mini Pacemaker Marvels

Mark Cuban is leading a transformative initiative in the pharmaceutical industry through the Mark Cuban Cost Plus Drug Company (MCCPDC), launched in 2022. Co-founded with radiologist Dr. Alex Oshmyansky, the company aims to reduce prescription drug costs by eliminating intermediaries like pharmacy benefit managers (PBMs) and adopting a transparent pricing model. MCCPDC sells generic medications directly to consumers at the manufacturer's cost plus a 15% markup, a $5 pharmacy service fee, and a $5 shipping fee, significantly undercutting traditional prices. For instance, a one-month supply of imatinib, a cancer medication, is priced at $13.40 through Cost Plus Drugs, compared to approximately $2,500 at conventional pharmacies.

To enhance its supply chain control and address drug shortages, MCCPDC opened a 22,000-square-foot manufacturing facility in Dallas, Texas, in 2023. This facility produces essential injectable medications, such as epinephrine and norepinephrine, which have experienced shortages in the past. Additionally, the company has expanded its offerings to over 2,200 generic drugs and is collaborating with healthcare systems like Penn Medicine to integrate its affordable medications into their pharmacy networks.

Beyond direct-to-consumer sales, Cuban is challenging the traditional PBM model by advocating for employers to bypass these intermediaries. Through initiatives like Cost Plus Wellness, he promotes direct contracting with providers to reduce healthcare costs for employees. Cuban's commitment to disrupting the pharmaceutical industry is driven by a desire to make medications more accessible and affordable, leveraging transparency and innovation to benefit consumers nationwide.

Rob: You’ve launched CostPlus with Dr. Alex Oshmyansky. Who has been most instrumental in advancing the CostPlus mission so far—physicians, health systems, or unexpected allies?

Mark: Patients sharing their savings and experiences with each other. When someone saves hundreds of dollars a month or a year, they tell others they know who are dealing with the same issues.

Rob: Has CostPlus sparked any unexpected partnerships—either with providers, employers, or policymakers—that surprised you or helped accelerate the mission?

Mark: So many. By publishing our full price list, we’ve opened the door to researchers, the FTC, companies, and patients to change behaviors and start using us.

Rob: Your platform is driving a new era of drug price transparency—just as Healthcare Bluebook is doing for medical procedures. Do you see this as the early days of a radical shift?

Mark: I hope so. I think what we’ll see is that providers will begin using procedure pricing as a way to attract patients, knowing some percentage will become very profitable through hospital stays.

I read MedTech news from papers and journals I respect. Here's the best of what I'm read this week.

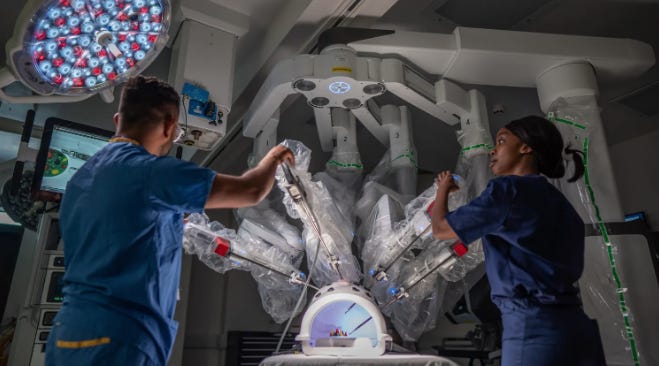

The NHS in England will begin using robotic systems for thousands of knee and hip replacements, marking a significant step in reducing surgical wait times. Approved by the National Institute for Health and Care Excellence (Nice), these systems will be used across 11 types of operations at specialist NHS centers, including tumor removal and hernia repair.

These surgical robots, costing between £500,000 and £1.5 million, offer enhanced precision by minimizing hand tremors and allowing minimally invasive procedures. Controlled via console or handheld use, the robotic arms can maneuver surgical instruments with greater dexterity, leading to faster recovery times and improved system efficiency.

Northwestern engineers have created the world’s smallest pacemaker, designed to be injected through a syringe and especially suited for newborns with congenital heart defects. The device pairs with a soft, wireless wearable that shines infrared light through the chest to activate the pacemaker, delivering precise electrical pulses without the need for wires or invasive removal procedures.

Smaller than a grain of rice, the pacemaker remains off until activated by light, allowing for controlled and temporary pacing during critical recovery periods, such as after pediatric heart surgeries. Once the heart stabilizes—typically within about a week—the pacemaker safely dissolves in the body, removing the risks associated with extracting traditional temporary pacing wires.

This breakthrough addresses a longstanding clinical need for gentler, safer pacing options in fragile patients. Powered by a galvanic cell that draws energy from the body’s own fluids, the device also opens new possibilities for use in other implantable systems, from heart valves to regenerative bioelectronics targeting nerves, bones, and wound healing.

Laser Photonics Corp. and CMS Laser are advancing ultrafast cold laser marking technology to meet the FDA’s strict UDI requirements for plastic medical devices. By using picosecond and femtosecond lasers, their systems create precise, durable markings that withstand cleaning and daily use without damaging sensitive materials.

Integrating machine vision and automation, the technology enhances accuracy and speeds up production by reducing human error. With on-the-fly processing and proprietary software, the companies aim to significantly increase throughput while ensuring traceability and safety in medical device manufacturing.

Medtronic has received FDA approval to pair its Simplera Sync glucose sensor with the MiniMed 780G insulin pump, allowing for fully automated insulin delivery. This update supports the company’s efforts to revitalize its U.S. diabetes business, with a limited launch of the new sensor expected this fall.

The Simplera Sync sensor is smaller, fingerstick-free, and tape-free, making it more competitive in the CGM market. Medtronic’s 780G system features advanced meal detection and aims for tighter glucose control, while the company also seeks label expansion for Type 2 diabetes and continues developing a proprietary CGM with Abbott.

FDA Commissioner Martin Makary announced a new policy to limit the participation of drug company employees as industry representatives on FDA advisory committees, aiming to reduce perceived conflicts of interest. While these representatives are non-voting and offer general industry perspectives, Makary argued their presence creates a "cozy relationship" that undermines public trust.

Under the new policy, industry employees can still attend and present at meetings but will no longer serve as official committee members unless legally required or under rare exceptions. Makary, aligned with HHS Secretary Robert F. Kennedy Jr., emphasized replacing industry representatives with patients or caregivers where possible, reflecting a broader effort to reduce corporate influence in federal health agencies.

Johnson & Johnson's electrophysiology segment saw a nearly 2% year-over-year sales decline in Q1 2025, despite the FDA approval and U.S. launch of its Varipulse pulsed field ablation (PFA) system. While the company’s broader cardiovascular portfolio grew by over 16% to $2.1 billion, the electrophysiology unit lagged behind competitors like Medtronic and Boston Scientific, both of which are experiencing rapid adoption and triple-digit growth in the PFA market.

J&J’s delayed entry into the PFA space, coupled with a five-week pause in Varipulse cases due to safety concerns, may have dampened physician confidence. Analysts suggest these setbacks could have a lasting impact on Varipulse’s perception, giving Medtronic and Boston Scientific a continued advantage as safer, more established alternatives in this fast-growing market.

Congress has passed the Tax Relief for American Families and Workers Act of 2024, a bipartisan bill that restores immediate expensing for research and development costs—an issue critical to the medtech industry. The bill delays the requirement to amortize R&D costs over five years until the end of 2025, allowing companies to deduct those expenses upfront.

Industry leaders like AdvaMed emphasized that the change will particularly benefit small and emerging medtech companies, helping avoid disruptions in clinical operations and delays in bringing new technologies to market. While the House passed the bill with overwhelming support, it still faces political hurdles in the Senate, particularly over the child tax credit provision.

Johnson & Johnson has completed the first clinical trial surgeries using its Ottava surgical robot, performing gastric bypass procedures as part of its push to gain FDA approval. The company plans to seek a U.S. indication for multiple upper abdominal general surgeries, including gastric sleeve, small bowel resection, and hiatal hernia repair.

Ottava is central to J&J’s strategy to enter the competitive robotic surgery market dominated by Intuitive Surgical’s da Vinci system. With four arms integrated into the operating table and enhanced digital connectivity through its Polyphonic system, Ottava aims to improve workflow, free up operating room space, and support complex soft tissue procedures.

Subscribe for more!